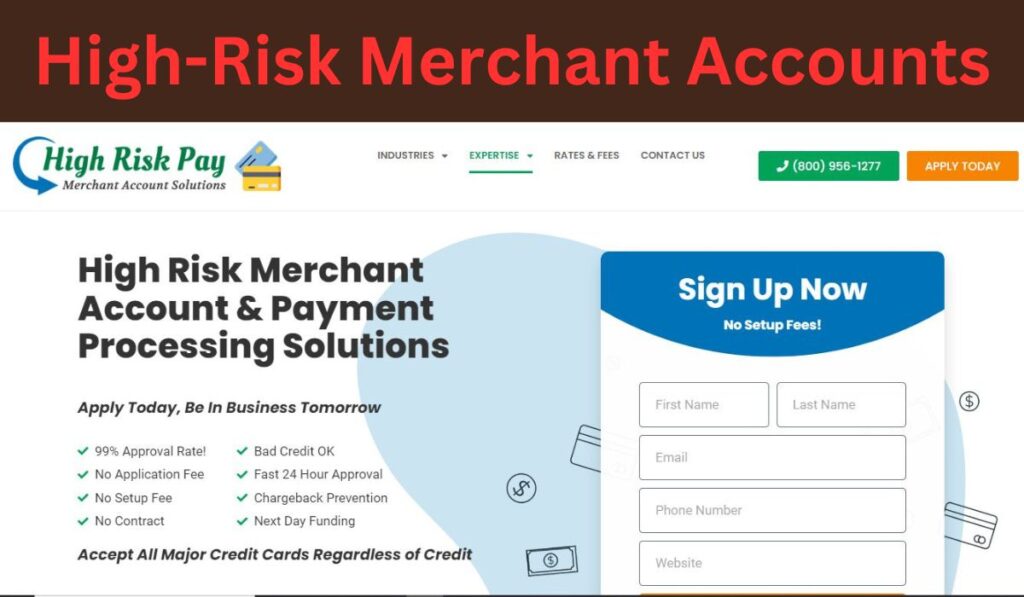

Since its inception in 1997, High-Risk Merchant highriskpay.com has experienced tremendous growth in the credit card region, positioning itself as a consultant for high-risk merchant bills. Guided by its mission of fulfilling customers and being a dependable company, High-Risk Pay seamlessly connects service provider bills with reliable credit card processing answers thru countrywide networks and trusted banks. Affordable pricing similarly enhances the attraction of their services, fostering the fulfilment of numerous agencies.

A splendid characteristic offered by using High-Risk Merchant highriskpay.com Pay is their round-the-clock stay customer support, making sure that customers have access to help whenever wanted. This dedication to customer support contributes to its reputation amongst agencies seeking secure and reliable charge answers.

Understanding High-Risk Merchant Accounts

An excessive-threat service provider High-Risk Merchant Accounts is an economic association designed for companies with an above-average transaction charge, which financial institutions deem as having an accelerated hazard of fraud. High-Risk Pay’s Highriskpay.Com understanding lies in assisting those companies decrease fraudulent prices, the charges related to chargebacks, and different capacity expenses. Particularly relevant to online organizations, excessive-threat service provider accounts provide a layer of safety towards online scams.

Why Choose High Risk Merchant Highriskpay.Com?

If your enterprise has a history of fraud, Highriskpay.Com a terrible credit score, or a high variety of chargebacks, a high-risk merchant account from High-Risk Pay may be a valuable answer. Certain industries, which include the grownup industry, subscription-based companies, and others, significantly gain from those debts as they provide safety against fraudulent customers.

Required Documents for High-Risk Merchant Highriskpay.Com Account

To apply for a high-risk merchant account with High-Risk Pay, the following documents are usually required:

1. Valid driver’s license

2. Proof of coverage coverage

3. Personal Identification Proof (PIN): A confidential numeric code used for ATM transactions; it ought to no longer contain personal data.

4. Business Registration Information, which might also consist of:

- Articles of incorporation

- Limited legal responsibility company articles

- Partnership agreements

- Documents substantiating the business’s legitimacy and monetary transaction authorization

How High-Risk Merchant Highriskpay.Com Accounts Operate

An excessive-hazard service provider account serves as a transactional arrangement between an enterprise owner and a financial institution or economic institution. This account permits the business to just accept bills via the bank’s payment processing system, encompassing each credit and debit card transaction. Factors together with commercial enterprise extent, chance degrees, and transaction frequency influence the associated prices.

The unique requirements and offerings supplied may vary amongst banks, with some requiring not less than years of operational records, while others may consider businesses that have previously encountered fraud.

Industries Associated with High-Risk Merchants Highriskpay.Com

Several industries are generally associated with high-danger merchant debts, which include:

- Adult Industry

- eCommerce

- Gambling

- Gaming

- Online Dating

- Multi-Level Marketing

- Debt Collection

- Vape Shops, E-Cigarettes, and CBD

- Subscription Services

Factors That Contribute to High-Risk Business Classification

Several factors contribute to the category of commercial enterprise owners, consisting of:

- 1. Large Transaction Volume: Businesses processing at least $20,000 per month or no less than $500 according to transaction are often categorized as excessive-threat merchants.

- 2. International Customer Base: Operating in high-hazard countries or internationally can lead to a high-chance category, apart from countries like the United States, Japan, Australia, Canada, and European Union members.

- 3. New Business: New agencies with restrained or no transaction history may be considered excessive risk.

- 4. High-Risk Industries: Certain industries, regardless of their document, fall into the excessive-threat category, including adult leisure, online gaming, and subscription offerings.

- 5. Low Credit Scores: Businesses with low credit score ratings may be deemed high hazard.

Highriskpay.com’s Areas of Expertise

Highriskpay.Com makes a speciality of numerous key regions, which include:

- 1. ACH Processing: Automated Clearing House (ACH) processing enables clean digital take look at processing, in particular, precious for high-risk industries.

- 2. Instant Approval: Highriskpay.Com gives on-the-spot application approval, streamlining the onboarding procedure for organizations.

- 3. Chargeback Prevention Program: Highriskpay.Com aids in lowering chargebacks by using about 86%, right away alerting merchants to cardholder disputes and helping prevent fraud.

Benefits of High-Risk Merchant HighriskPay.Com Accounts

Highriskpay.Com debts provide numerous blessings, consisting of:

- 1. Global Market Access: These accounts allow businesses to faucet into the worldwide market, accepting orders in various currencies without challenge.

- 2. Chargeback Protection: Highriskpay.com accounts offer protection against chargebacks, enhancing a commercial enterprise’s popularity and price.

- 3. Acceptance of Debit and Credit Card Payments: Highriskpay.com incorporates each credit and debit card transaction, appealing to a huge range of customers.

- 4. Enhanced Security: HHighriskpay. com offers robust security features, safeguarding both companies and customers.

- 5. Customer Satisfaction: The transparency provided by Highriskpay.Com regarding protection, payments, and foreign exchange fosters consumer pride.

Alternatives to Highriskpay.Com

If Highriskpay.Com does no longer meet your needs, bear in mind these options:

- 1. Durango Merchant Services

- 2. Soar Payments

- 3. SMB Global

- 4. Paymentcloud

- 5. Host Merchant Services

Conclusion

In end, High-Risk Pay has hooked up itself as a dependable accomplice for corporations in need of high-hazard merchant money owed. Their dedication to patron delight, knowledge in diverse industries, and array of offerings cause them to make a strong choice. For those seeking options, numerous different legit options can cater to specific business requirements. Whether you pick out High-Risk Pay or explore opportunity carriers, securing an excessive-chance merchant account is a vital step in the direction of mitigating risks and ensuring the achievement of your business.

FREQUENTLY ASKED QUESTIONS(FAQS)

Ans: A high-chance service provider account is a specialized financial association offered to agencies with an above-common risk of fraud or chargebacks. It permits those businesses to accept credit score and debit card bills even as they impart extra security features to decrease capacity losses.

Certain industries, inclusive of the personal leisure, playing, and on-line courting sectors, have a better likelihood of chargebacks and fraudulent activities. High-danger service provider accounts are tailored to those industries to help mitigate these risks and guard both the business and its customers.

High-Risk Pay specializes in linking merchant accounts that rely on credit card processing solutions through countrywide networks and professional banks. They provide offerings consisting of ACH processing for digital check payments, instant application approval, and chargeback prevention software to reduce losses due to disputes and fraud.

Yes, excessive-hazard merchant bills, like those offered through High-Risk Pay, can provide entry to the worldwide market. Businesses can accept bills in diverse currencies and cater to global clients, making it simpler to tap into a broader purchaser base.

Yes, there are opportunity provider companies that cater to organizations in need of excessive-threat merchant debts. Some of these options consist of Durango Merchant Services, Soar Payments, SMB Global, Paymentcloud, and Host Merchant Services. These carriers provide comparable services and benefits to help high-danger groups control bills and decrease.