Introduction

Welcome to How2Invest – your widely inclusive speculation guide intended to furnish readers with important bits of knowledge and efficient mandates for pursuing canny financial choices.

What Is How2Invest?

How2Invest remains a comprehensive asset focused on unwinding the complexities of different financial instruments and venture strategies. With an immovable commitment to unbiasedness, this platform is custom-fit to improve financial literacy across a range of audiences, from beginner financial backers to prepared specialists.

From the essential precepts of significant worth-driven ventures to the wisdom of underestimated resources, How2Invest engages people with crucial perceptions to facilitate judicious choices. Also, our centre stretches out to direct clients toward enhanced portfolios that suitably reduce gambles while improving likely returns.

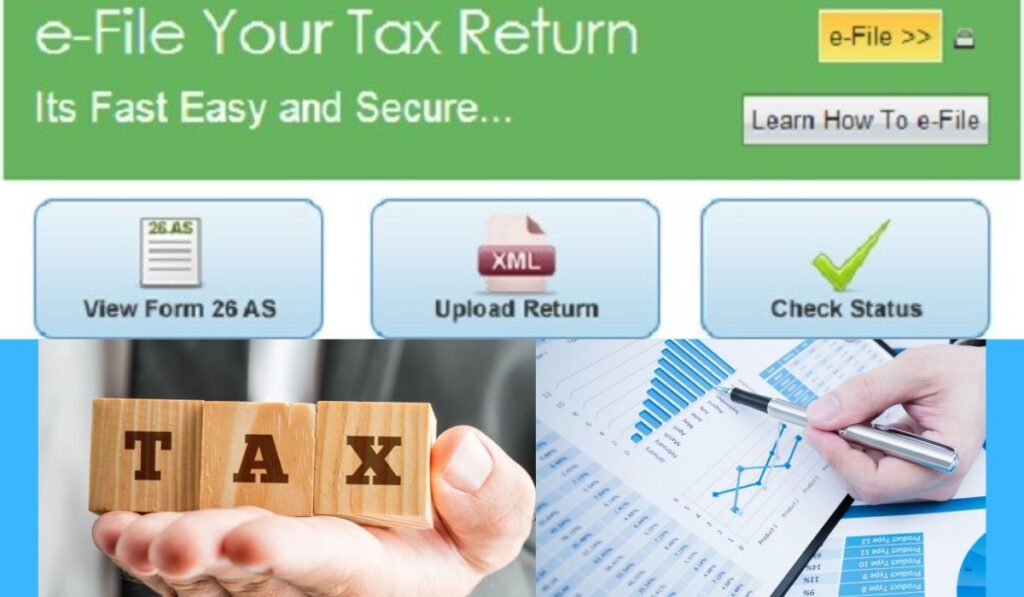

How To File an ITR Online?

Guidelines for Online Income Tax Return (ITR) Filing

For the seamless filing of your Income Tax Return (ITR) online, adhering to the following comprehensive steps is imperative:

- Registration on the Income Tax Department’s E-filing Portal:

Initiate the process by visiting the official website of your country’s Income Tax Department and registering as a taxpayer. Furnish requisite particulars such as your PAN (Permanent Account Number), name, date of birth, and pertinent contact details.

2. Accessing Your Account:

Post-registration, access your account by utilizing your designated user ID (PAN) and password. In some jurisdictions, you might be required to input a one-time password (OTP) dispatched to your registered mobile number or email address.

3. Selection of Appropriate ITR Form:

Determine the applicable Income Tax Return (ITR) form, aligning it with your income sources and classification. The assortment of forms available for selection may vary depending on your country’s specific tax statutes.

4. Precision in Information Input:

Ensure meticulous completion of the ITR form by accurately populating the requisite details. This encompasses personal particulars, income particulars, deductions, and the quantum of tax liability.

5. Validation and Tax Computation:

Thoroughly validate the inputted information in the form to guarantee precision. Leveraging the inbuilt calculators or software offerings furnished by the e-filing portal, undertake the computation of your tax obligations.

6. Settlement of Outstanding Tax Liability:

In instances where a tax liability is ascertained, promptly effectuate the settlement through the array of online payment mechanisms extended by the tax department.

7. Generation and Submission of ITR:

Upon meticulous validation and tax calculation, generate an XML file encapsulating the completed ITR form. Subsequently, proceed to submit the generated XML file on the e-filing portal via the designated upload interface.

8. ITR Verification:

Post submission, the necessity to verify your ITR emerges. This can be seamlessly executed through digital channels encompassing Aadhaar OTP, net banking, or alternately, by transmitting a physically signed ITR-V (Verification) form to the stipulated address of the tax department, within the designated timeframe.

9. Acknowledgment and Processing:

Following successful verification, anticipate receiving an acknowledgment from the tax authority. Subsequently, the tax department will effectuate the processing of your ITR, encompassing the issuance of any merited refunds or requisite measures in consonance with the provided data.

It is noteworthy that procedural nuances might slightly deviate contingent upon the unique requisites and protocols of your country’s tax administration. It is judicious to access the official website of your country’s Income Tax Department for exhaustive directives and guidelines pertinent to the online filing of ITR.

How To Start Investing In Mutual Funds?

Embarking on an investment journey within the realm of mutual funds can serve as a prudent avenue for cultivating wealth and realizing your financial aspirations. The ensuing step-by-step elucidation endeavours to offer sagacious guidance for your initiation:

- Cultivate Proficiency:

- Preamble your investment endeavours by acquiring a comprehensive grasp of mutual funds, encompassing their mechanics, typologies, and assorted classifications. This domain encompasses equity funds, debt funds, hybrid funds, index funds, and more. Prudent research and comprehensive comprehension of these variants are pivotal to aligning your investment strategy with your financial ambitions and risk threshold.

- Articulate Your Objectives:

- Meticulously define your investment objectives, illuminating whether your focus rests upon retirement, major acquisitions, or the accumulation of affluence. Your articulated goals will function as a cornerstone for your overarching investment blueprint.

- Gauge Risk Tolerance:

- Undertake a discerning evaluation of your proclivity toward risk. Different mutual funds encompass distinct echelons of risk exposure. While high-risk funds may augur potentially elevated returns, they invariably accompany augmented volatility. Conversely, conservative funds might engender more stable progress albeit potentially at a moderated rate of return.

- Opt for a Fitting Mutual Fund Entity:

- Navigating through reputable mutual fund companies or asset management establishments is paramount. Prioritize entities with a storied track record, distinguished customer service, and a diversified spectrum of fund alternatives.

Apprehension of Pertinent Tax Legislation and Regulatory Framework in 2023

The cognizance of extant tax statutes and investment regulatory protocols is a cornerstone for every investor. Taxation frameworks, overseen by the Office of Tax Policy under the aegis of the U.S. Department of the Treasury, exert a momentous influence on the taxation facets of investments.

Directives pertaining to these rules are disseminated and administered by the Internal Revenue Service (IRS). Investors are advised to recognize that capital gains accruing from their investments, alongside dividends received, are characterized as taxable income. Notwithstanding, a plethora of tax incentives is at the disposal of investors through retirement accounts, thereby orchestrating a reduction in their tax obligations while amplifying their provisions for the future.

Optimal How To Invest Strategies for 2023

Selecting the most appropriate investment strategies is pivotal in realizing financial objectives and cultivating wealth. The ensuing are four efficacious strategies meriting consideration:

- Portfolio Diversification:

- An elemental precept of investing resides in diversifying one’s portfolio. Spreading investments across assorted asset classes, industries, and global locales serves to curtail risk exposure and augment prospects for expansion. Diversification effectively mitigates vulnerability to fluctuations inherent in singular investments.

- Dollar-Cost Averaging:

- This method involves a systematic investment of a predetermined sum at consistent intervals, irrespective of market circumstances. By perpetually procuring more shares during market troughs and fewer shares during zeniths, a harmonized average cost per share over time is achieved.

- Long-Term Investment:

- An investment stance characterized by its protracted horizon enables harnessing the potency of compounding. Historic trends underscore markets’ overarching ascension despite transient volatility. By resolutely adhering to long-term aspirations and refraining from impulsive responses to market undulations, the potential for heightened yields can be realized.

- Value-Oriented Investment:

- Practitioners of value investment discern equities they deem undervalued by the market. This stratagem involves exhaustive scrutiny and analysis, culminating in the identification of enterprises boasting robust fundamentals, tradable at a markdown relative to their intrinsic value.

Conclusion

In the unique domain of investment and taxation, informed choices are made for monetary achievement. How2Invest outfits you with information to settle on sharp decisions, while our far-reaching ITR filing guide guarantees an issue-free way to deal with satisfying your duty commitments. Embrace these devices to unhesitatingly explore the complex universe of finance and accomplish your establishing long-term financial stability objectives.

5 FAQs At How2Invest

Invest wisely to grow wealth over time.

Investing involves putting money into assets with the aim of gaining returns.

Start with research, diversify investments, and consider a financial advisor.

Government bonds and fixed deposits are generally considered safe options.

Consider mutual funds or a diversified portfolio based on your risk tolerance.

Explore a mix of mutual funds, fixed deposits, and stocks after careful research.

Also Read: High-Risk Merchant highriskpay.com: A Comprehensive Overview